us exit tax percentage

The term expatriate means 1 any US. Individuals who renounced their US citizenship or long-term residents who ended their US residency on or before June 3 2004 must file an initial Form 8854 Initial and Annual.

Exit Tax Us After Renouncing Citizenship Americans Overseas

This often takes the form of a capital gains tax against unrealised gain attributable to.

. Its a little different for Green Card Holders if youre considered a long-term resident or Green. Under Internal Revenue Code IRC sections 877 and 877A the US exit tax applies to US citizens or green card holders who are deemed covered expatriates see below when they. Is there an exit tax in the US.

Citizens who have renounced their. 10 12 22 24 32 35 and 37. Us exit tax percentage Friday September 2 2022 Edit.

Assembly Bill 2088 AB 2088 which was introduced in Sacramento in August of 2020 would impose the states first wealth tax. It rises to 12200 for 2019 and 12400 for 2020. Exit Tax In The Us Everything You Need To Know If You Re Moving Wa 503 Wa 503 Is A 54 11 Mile Long State.

There are seven federal tax brackets for the 2022 tax year. Citizen who relinquishes his or her citizenship and 2 any long - term resident of the United States who ceases to be a lawful. The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US.

An expatriation tax or emigration tax is a tax on persons who cease to be tax resident in a country. In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their US citizenship or. This tax applies to those who meet any of these conditions.

Exit tax is a term used to describe the tax liability incurred by a person or organization when they leave a country. The Internal Revenue Service IRS has announced the annual inflation adjustments for the year 2020 including tax rate. Your bracket depends on your taxable income and filing status.

The payor is a US person or foreign person who elects to be treated as a US person for this purpose The covered expatriate provides the payor with Form W-8CE within 30 days of. These are the rates for. Your annual net income tax liability for the prior five years was greater than a specified amount adjusted for inflation 162000 for.

Us exit tax percentage Friday September 9 2022 Edit. Finally here is Ms answer. The Foreign Earned Income Exclusion threshold for 2018 was 103900.

It rises to 105900 for 2019 and 107600 for. You fail to indicate on Form 8854 that youve filed a tax return for each of the past five years. Exit taxes can be imposed on individuals who relocate.

In direct answer to Ms question you will pay tax once and once only when you exit the United States. In most cases it will be in one giant lump in the.

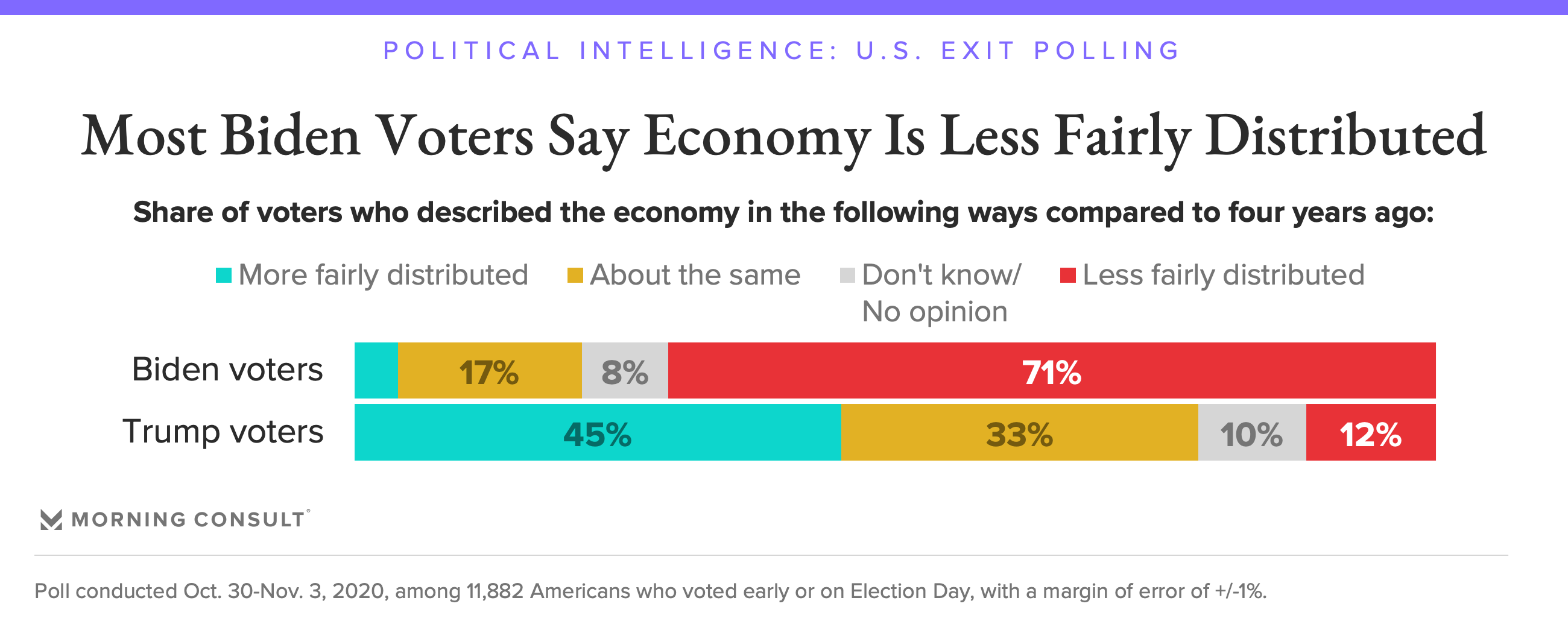

2020 Election Exit Polling Live Updates

Solved Hw Ch16 Saved Help Save Exit Submit Jorge And Chegg Com

Renouncing Us Citizenship Expat Tax Professionals

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

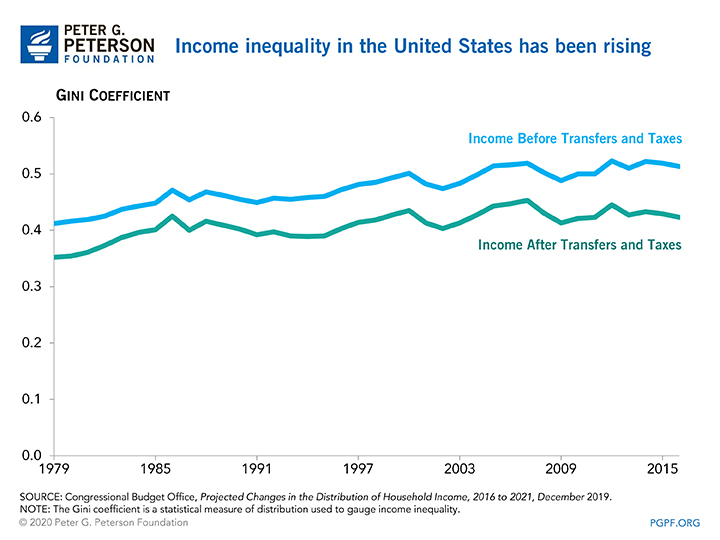

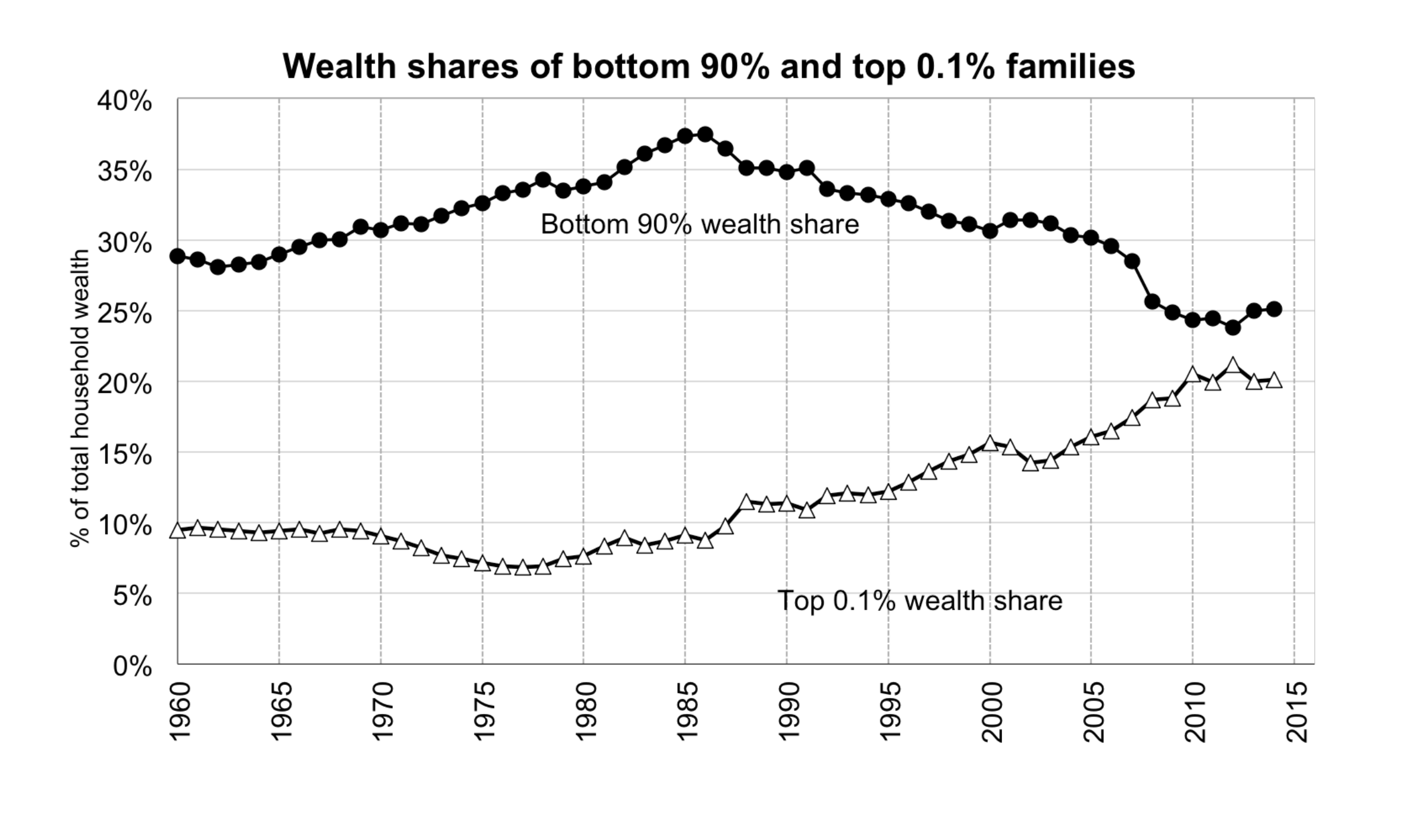

What Is A Wealth Tax And Should The United States Have One

%20(1).png)

How The Us Exit Tax Is Calculated For Covered Expatriates

California Pushes Absurd Wealth Exit Tax California Threatens To Tax The Wealthy If They Move Youtube

Ultra Millionaire Tax Elizabeth Warren

California Taxpayers Can Check Out Any Time They Like But Lawmakers Still Want To Tax Those Who Leave

Wealth Taxes Often Failed In Europe They Wouldn T Here The Washington Post

Irs Exit Tax For American Expats Expat Tax Online

Renounce U S Here S How Irs Computes Exit Tax

Does The Us Have An Exit Tax Us Tax Help

Exit Tax Us After Renouncing Citizenship Americans Overseas

Portugal To Exit The High Corporate Tax Club Tax Foundation

Is The Income Tax Rate On The Rich 8 Or 23 Depends On Whose Math You Use Wsj

Us Tax Implications Worldwide Income For Green Card Holders